Israel’s latest strike on Iran sparks currency fluctuations

The international currency fluctuations caused by Israel’s latest strike on Iran have now settled due to Tehran’s lack of retaliation, according to Reuters.

The overnight strike on Iran led to an increase in the value of the Swiss franc and the Japanese yen. However, since Iran considered the attack to be of limited-scale, the currencies have been stable since 19th April.

Following news of Israel’s move, the US dollar fell 0.2% against the Swiss franc, meaning that 1 USD equated to 0.91 franc.

READ: Egypt: President Al-Sisi declares economic dollar crisis

Pre-strike, the dollar was slightly below the yen at 154.57 yen per USD, however, post-attack, the dollar dropped to 153.59 yen.

“The market initially reacted poorly because of the premise of an Israel response,” stated Eugene Epstein, head of structuring for North America at Moneycorp in New Jersey.

The market’s rapid reaction sparked a sell-off in risk assets, raised the value of oil and gold, and started a rally in US treasuries and safe-haven currencies (currencies that serve as reliable or stable stores of value).

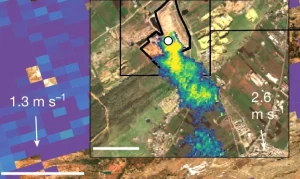

Iranian media and officials declared that the country’s air defences hit three Israeli drones over Isfahan, a city in central Iran, which caused several small explosions.

READ: Iran’s FM worried Israel wants to expand war

It is rumoured that the recent attack was a retaliation to Iran’s assault on Israel after it suspected that Israel was behind the strike on the Iranian consulate in Syria.

The Guardian reported that the recent Israeli strike came quicker than expected, after the countries back and forth of small assaults on each other since 1st April. Diplomacy and drones: how Israel’s reported attack on Iran unfolded.

US and Israeli officials had predicted that any action would have come after Passover, a significant Jewish holiday that begins on 22nd April.

Reuters/The Guardian

Want to chase the pulse of North Africa?

Subscribe to receive our FREE weekly PDF magazine