Dalia Ghanem: Algeria-Italy ties are reshaping the Mediterranean

After shutting out traditional partners France and Spain, Algeria has quickly expanded ties with Italy with larger geopolitical implications for the region.

When Algerian President Abdelmadjid Tebboune arrived in Rome on July 24 for a state visit, the diplomatic language expressed alongside Italian Prime Minister Giorgia Meloni was effusive. Both leaders described an increasingly crucial partnership to their respective broader strategic ambitions. Tebboune pointed to Italy as “an essential and serious partner in accompanying Algeria’s ambitious economic momentum,” while Meloni declared that her country’s determination to become “a hub, a gateway for energy to Europe” could not be achieved “without Algeria’s valuable cooperation.”

Behind the summit’s handshakes and the signing of over 40 agreements—spanning from subsea data cables to vehicle manufacturing—lies a quiet, yet substantive shift in Mediterranean geopolitics. For Italy, this partnership is the cornerstone of its “Mattei Plan for Africa,” a vision to establish itself as a crucial bridge between Europe and its southern continental neighbor. For Algeria, it is a meticulously engineered effort to escape the gravitational pull of its fraught relationships with France and Spain and forge a new power center with a crucial anchor in Europe.

This Algiers-Rome axis is far more than a simple deal for natural gas; it redraws the geopolitical map of the Mediterranean, granting Algiers solid diplomatic leverage within the European Union and a potent counterbalance to the long-standing influence of the Paris-Madrid-Rabat axis, a bloc that Algiers has long viewed as a strategic threat designed to isolate it. But with Mediterranean regional dynamics in constant flux, the critical question remains: Is this new axis built to last, or is it a fragile partnership of convenience?

A Partnership Forged in Crisis

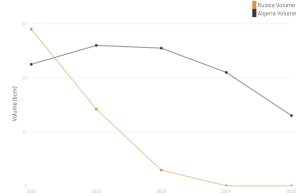

The catalyst for this alliance was, undeniably, energy demand. As Russian pipelines to Europe shut down after the invasion of Ukraine in February 2022, Italy, once heavily reliant on Russian energy giant Gazprom, turned south. The data reveals a stark reversal: In 2021, Italy imported 29 bcm of gas from Russia versus 22.5 bcm from Algeria. By 2023, Russian volumes had collapsed to a mere 2.9 bcm. The enormous gap was largely filled by a surge in liquefied natural gas (LNG) imports, primarily from the United States and Qatar, while Algerian supplies held strong at 25.5 bcm, valued at an impressive $14 billion. By 2024, pipelined gas from Russia had all but ceased, and Algeria emerged as Italy’s indispensable energy anchor—a fact cemented by a $1.35 billion deal between Italy’s Eni and Algeria’s Sonatrach.

Italy Natural Gas Imports by Source: Volumes

Yet, to see this as just a story about hydrocarbons is to miss the larger geopolitical gambit. For Algiers, Italy is not just a growing customer; it is a powerful replacement for its traditional partners. The most dramatic evidence of this came in its diplomatic rupture with Spain in 2022. When Madrid reversed its long-held neutrality on Western Saharan independence that year to align with Morocco’s position, Algeria’s response was swift and severe. It suspended a two-decade-old treaty of friendship and initiated a comprehensive trade boycott that cost Spanish businesses an estimated €930 million ($986 million) in just three months, a clear signal that Algiers was willing to absorb economic pain to enforce its political red lines. While the Algiers-Madrid relationship crumbled, and ties with Paris frayed, over a host of recurring diplomatic disputes, including historical memory, visa restrictions, and French policy in the Sahel, reaching their lowest point in decades between 2024 and 2025, the Rome-Algiers axis solidified, signaling that Algeria would no longer tolerate unfavorable terms from its traditional European interlocutors.

All Roads Lead from Algiers

Crucially, the foundation of this new axis is being purposefully diversified beyond hydrocarbons, insulating it from the volatility of commodity markets and the pressures of Europe’s green transition. The partnership is following a deliberate “twin-track” approach: using Algerian gas as a transitional “bridge fuel” for current security, while simultaneously co-developing renewable energy sources for the future. This long-term vision is now being advanced through ambitious strategic initiatives. The proposed SoutH2 Corridor, a planned 3,300 km pipeline, aims to transport green hydrogen produced in Algeria into the heart of Europe, aligning with the EU’s objective to import 10 million tons of renewable hydrogen by 2030. This positions Italy as a hub for both natural gas and future green energy, while offering Algeria a path to monetize its vast solar and wind potential long after the world transitions away from fossil fuels.

This Algiers-Rome axis is far more than a simple deal for natural gas; it redraws the geopolitical map of the Mediterranean.

The geopolitical payoff is also already evident. A new Rome-Algiers alignment is creating a diplomatic counterweight to the Paris-Madrid-Rabat bloc. On critical issues like the crisis in Libya and the Sahel, Italian and Algerian positions have begun to converge, and often stand in contrast to French-led initiatives. In Libya, both countries support the UN-recognized government in Tripoli, while France had been seen as tacitly supporting Filed Marhsall Khalifa Haftar in the east. Similarly, in the Sahel, both Rome and Algiers opposed a military intervention in Niger following the 2023 coup, advocating for a negotiated transition while France supported efforts by the West African regional grouping ECOWAS to reverse the military coup.

This diplomatic alignment is the deliberate outcome of a new relationship where energy security provides the foundation for political cooperation, diminishing the role of traditional actors. The strategy is not without risks, however. Skeptics correctly point to Algeria’s tight gas export capacity and domestic political risks, while others warn that Italy is merely swapping a dependency on Moscow for one on Algiers.

READ: Rachel Marsden: EU throws tantrum as Trump meets Putin

These are valid concerns, but for now, they are being eclipsed by the immense strategic benefits. For Italy, the partnership secures its energy supply and elevates its status as a European energy hub. For Algeria, the rewards are even greater: a vital economic lifeline, drastically reduced its traditional dependence on France and Spain, and engineering strategic relevance at the heart of the Mediterranean. This could force difficult reassessments in capitals like Paris and Madrid, which can no longer take their historical positions for granted. It also intensifies the strategic pressure on Morocco along its eastern border, exacerbating the regional security dilemma. The question is no longer whether the Mediterranean map is changing, but how quickly other regional actors can adapt to the new reality being drawn by the Rome-Algiers axis, and what new countermoves this gambit will inevitably provoke.

The views expressed in this article belong to the author and do not necessarily reflect the editorial policy of Maghrebi.org. Dalia Ghanem is a senior fellow and director of the Conflict and Security Program at the Middle East Council on Global Affairs. Her research focuses on Middle Eastern and North African politics, including issues of political violence, radicalisation, civil-military relations, and gender studies.

If you wish to pitch an opinion piece please send your article to grace.sharp@maghrebi.org

Want to chase the pulse of North Africa?

Subscribe to receive our FREE weekly PDF magazine