Libya: oilfield shutdowns spread amid central bank dispute

The tremors of Libya’s central bank crisis continue to be felt as oilfield closures spread across the nation, with two field engineers stating that the Sarir field has almost wholly halted output, reported Reuters and agencies on August 28th.

In eastern Libya, where most of the country’s oilfields lie, authorities declared on August 26th that all production and exports would be halted.

Engineers stated that the Sarir field produced around 209,000 barrels per day (bpd) before output was halted.

The Sharara field, which produces 300,000 bpd, had recently announced force majeure on exports, and additional disruptions have been reported at El Feel, Amal, Nafoora and Abu Attifel.

Libya, a member of OPEC, produced approximately 1.18 million barrels of oil per day in July.

READ: Libya: armed groups and authorities reach security deal in Tripoli

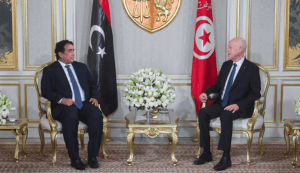

The move to cut Libya’s primary source of revenue was triggered by Presidency Council Chief Mohammed al-Menfi’s decision to sack Central Bank of Libya (CBL) chief Sadiq al-Kabir. This led to greater instability in the country as rival armed factions decided to mobilise.

Prime Minister Abdulhamid al-Dbeibah, who leads the Tripoli-based Government of National Unity, stated last week that oilfields should not be closed “under flimsy pretexts”.

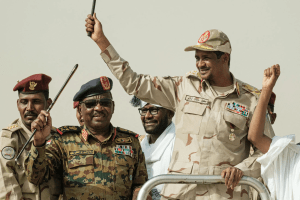

On August 27th, U.S. Africa Command General Michael Langley and Charge d’Affaires Jeremy Berndt met Khalifa Haftar, the head of the Libyan National Army, which controls the country’s east and south.

The U.S. Embassy in Libya posted on X, “The United States urges all Libyan stakeholders to engage constructively in dialogue,” with the assistance of the United Nations Support Mission, also based in Libya and the international community.

However, the expected hikes in oil prices due to potential supply losses in Libya and other nations were offset. Benchmark Brent oil prices fell by 1.2% to $78.35 as of 10:39 GMT due to concerns over decreased Chinese demand and risks of a broader economic slowdown.

Reuters and agencies.

Want to chase the pulse of North Africa?

Subscribe to receive our FREE weekly PDF magazine